The new virtual bank of Argentina, Brubank, appears with free contactless cards and also in physical and digital version with the idea of consuming from anywhere.

When I mention that it is free of cost It refers to the fact that there are no charges for account opening, maintenance, transfers, withdrawal from ATMs and payments to public or private services.

The single expense that would be applied for this product is by card Replacement, in case of loss or breakage with about $75 pesos and withdrawal at ATMs abroad.

However, it is possible to use at home and abroad for buy through the digital application.

According to the entity, financial processes are transparent with no fine print and authorized by the Central Bank.

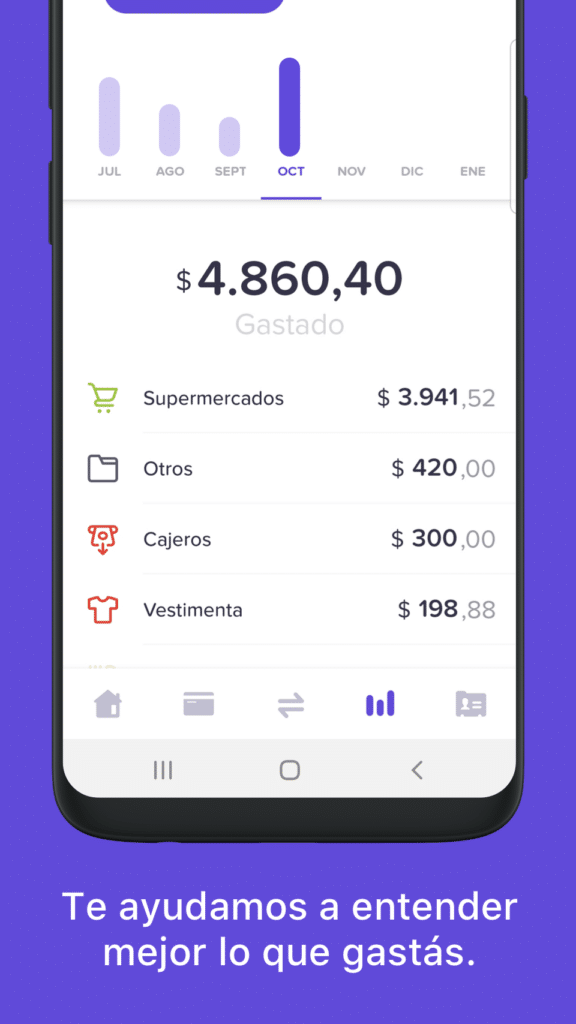

Through the app you can manage and organize consumption Through specific categories, according to travel, pet, delivery, supermarket, among other important ones within personal finance.

In the same way, it has another type of products that may be of interest, such as a savings bank with different currencies, personal loans, purchase and sale of dollars, search engine for transactions without a time limit, etc.

Image credit: Shutterstock

Which are the requirements?

- Be over 18 years old.

- Have Argentine DNI and be resident in the country.

- Owning a smartphone to receive notifications

How does the purple visa card work?

The brubank card It is very easy to handle through the virtual program that will explain in detail the steps to follow without having to queue or submit thousands of bureaucratic documents.

Also, it has some extra benefits, What:

- Biometrics: Allows access to the personal account using the customer's fingerprint or face.

- Staff: You can enter one electronic device at a time for security, that is, once you enter the account from your computer, you will not be able to access it from your smartphone.

- Token: The second option to protect user operations is through the Token, a security code that the app automatically generates to make transfers.

- encrypted: All account movements are 100% encrypted for your convenience.

Benefits

The debit card has exclusive benefits for allies of Visa together with the best practices in cybersecurity to acquire loyalty with the user and avoid complications when managing the account.

- Receive and send money at no cost.

- Free and immediate transfers.

- You do not need to go through a waiting list or coordinate cards.

- Buy and sell dollars 24 hours a day.

- Customer service always available.

- Fixed term loans.

Brubank communication channels

Inside of digital platform, Brubank, there is a button to download the app directly on the cell phone with Android or iOS system.

The different accounts of the social networks, What: Facebook, Twitter and instagram.

Do not forget to clarify your doubts with the assistants of the bank before accepting the terms and conditions. If you liked the content, access and share our Finance category to learn more.